Deep-pocketed investors have adopted a bearish approach towards MercadoLibre (NASDAQ:MELI), and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MELI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 9 extraordinary options activities for MercadoLibre. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 11% leaning bullish and 88% bearish. Among these notable options, 3 are puts, totaling $373,960, and 6 are calls, amounting to $284,493.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $1500.0 to $1800.0 for MercadoLibre during the past quarter.

Insights into Volume & Open Interest

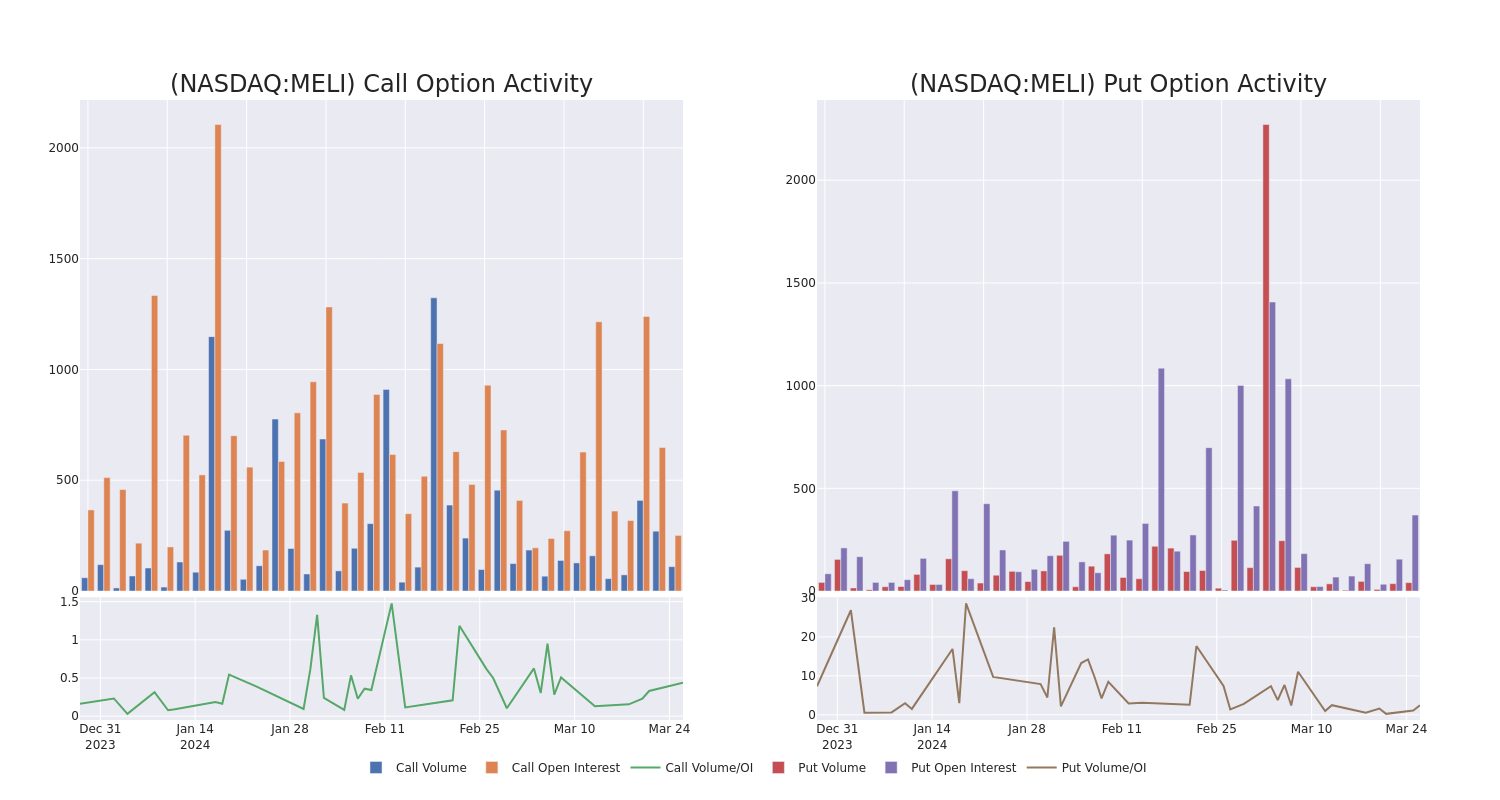

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MercadoLibre’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MercadoLibre’s whale activity within a strike price range from $1500.0 to $1800.0 in the last 30 days.

MercadoLibre Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| MELI | PUT | SWEEP | BEARISH | 06/20/25 | $1500.00 | $303.0K | 7 | 15 |

| MELI | CALL | TRADE | NEUTRAL | 05/17/24 | $1600.00 | $61.5K | 88 | 25 |

| MELI | CALL | SWEEP | BEARISH | 05/17/24 | $1600.00 | $54.6K | 88 | 7 |

| MELI | CALL | SWEEP | BULLISH | 09/20/24 | $1550.00 | $53.5K | 6 | 3 |

| MELI | CALL | TRADE | BEARISH | 04/12/24 | $1550.00 | $42.0K | 14 | 11 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre’s Current Market Status

- With a trading volume of 45,109, the price of MELI is down by -0.37%, reaching $1544.31.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 36 days from now.

Expert Opinions on MercadoLibre

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $2050.0.

- In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $2000.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on MercadoLibre with a target price of $2150.

- In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $2000.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MercadoLibre options trades with real-time alerts from Benzinga Pro.