Deep-pocketed investors have adopted a bullish approach towards Lululemon Athletica (NASDAQ:LULU), and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in LULU usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 32 extraordinary options activities for Lululemon Athletica. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 50% bearish. Among these notable options, 17 are puts, totaling $1,696,072, and 15 are calls, amounting to $718,160.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $365.0 and $470.0 for Lululemon Athletica, spanning the last three months.

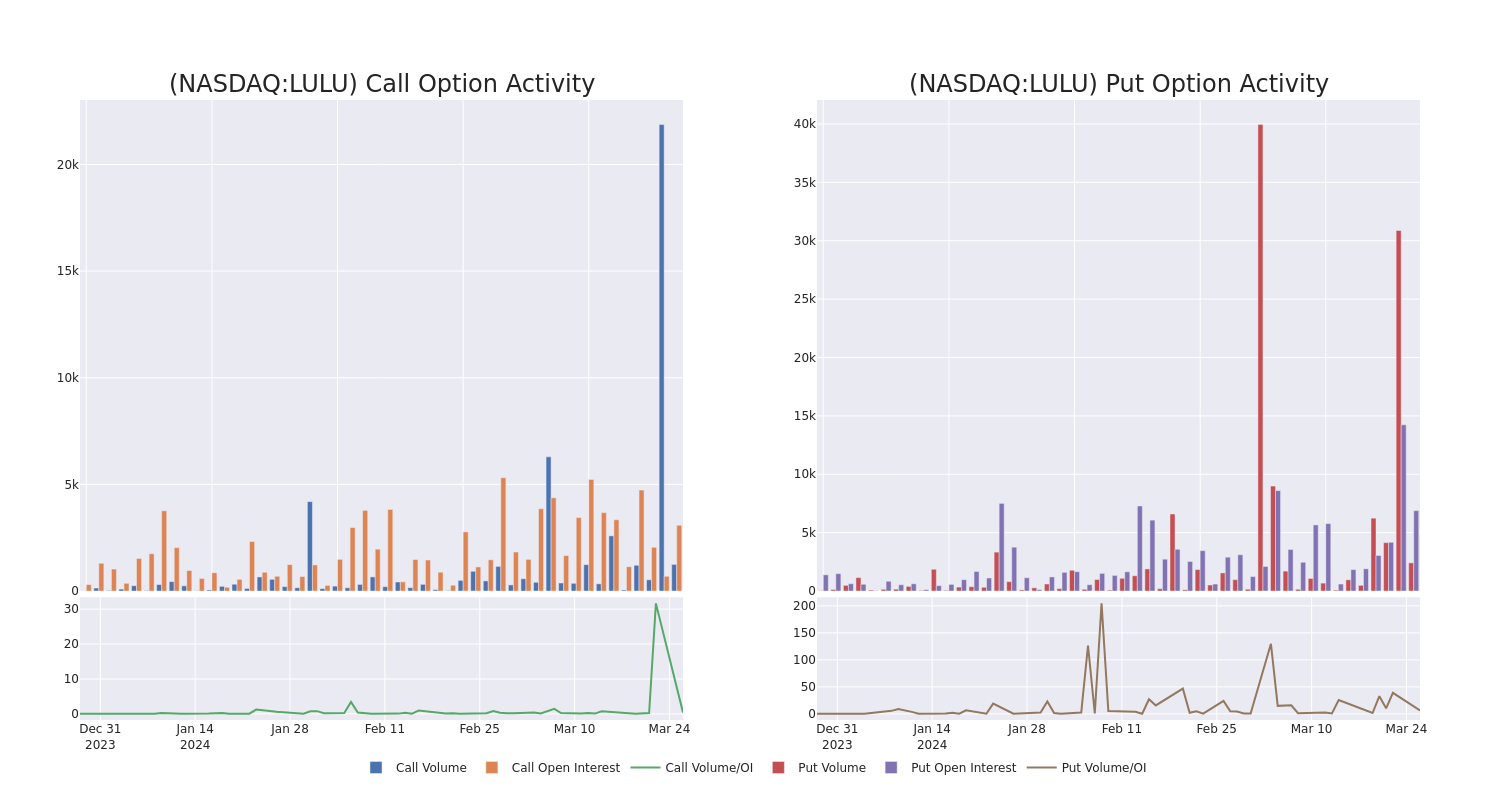

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Lululemon Athletica’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Lululemon Athletica’s whale trades within a strike price range from $365.0 to $470.0 in the last 30 days.

Lululemon Athletica Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| LULU | PUT | SWEEP | NEUTRAL | 04/19/24 | $400.00 | $299.5K | 1.0K | 208 |

| LULU | PUT | SWEEP | NEUTRAL | 03/28/24 | $445.00 | $229.2K | 126 | 43 |

| LULU | PUT | SWEEP | NEUTRAL | 03/28/24 | $440.00 | $207.7K | 125 | 51 |

| LULU | PUT | SWEEP | NEUTRAL | 04/19/24 | $390.00 | $187.5K | 442 | 212 |

| LULU | CALL | TRADE | BULLISH | 04/19/24 | $390.00 | $104.6K | 407 | 234 |

About Lululemon Athletica

Lululemon Athletica designs, distributes, and markets athletic apparel, footwear, and accessories for women, men, and girls. Lululemon offers pants, shorts, tops, and jackets for both leisure and athletic activities such as yoga and running. The company also sells fitness accessories, such as bags, yoga mats, and equipment. Lululemon sells its products through more than 680 company-owned stores in 19 countries, e-commerce, outlets, and wholesale accounts. The company was founded in 1998 and is based in Vancouver, Canada.

In light of the recent options history for Lululemon Athletica, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Lululemon Athletica

- Currently trading with a volume of 968,811, the LULU’s price is up by 1.06%, now at $393.02.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 65 days.

What Analysts Are Saying About Lululemon Athletica

In the last month, 5 experts released ratings on this stock with an average target price of $495.2.

- An analyst from Wedbush persists with their Outperform rating on Lululemon Athletica, maintaining a target price of $492.

- Maintaining their stance, an analyst from Telsey Advisory Group continues to hold a Outperform rating for Lululemon Athletica, targeting a price of $550.

- An analyst from JP Morgan has decided to maintain their Overweight rating on Lululemon Athletica, which currently sits at a price target of $509.

- Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Lululemon Athletica with a target price of $500.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lululemon Athletica, targeting a price of $425.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lululemon Athletica options trades with real-time alerts from Benzinga Pro.