Financial giants have made a conspicuous bullish move on Micron Technology. Our analysis of options history for Micron Technology (NASDAQ:MU) revealed 32 unusual trades.

Delving into the details, we found 43% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $584,990, and 23 were calls, valued at $2,417,474.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $75.0 and $120.0 for Micron Technology, spanning the last three months.

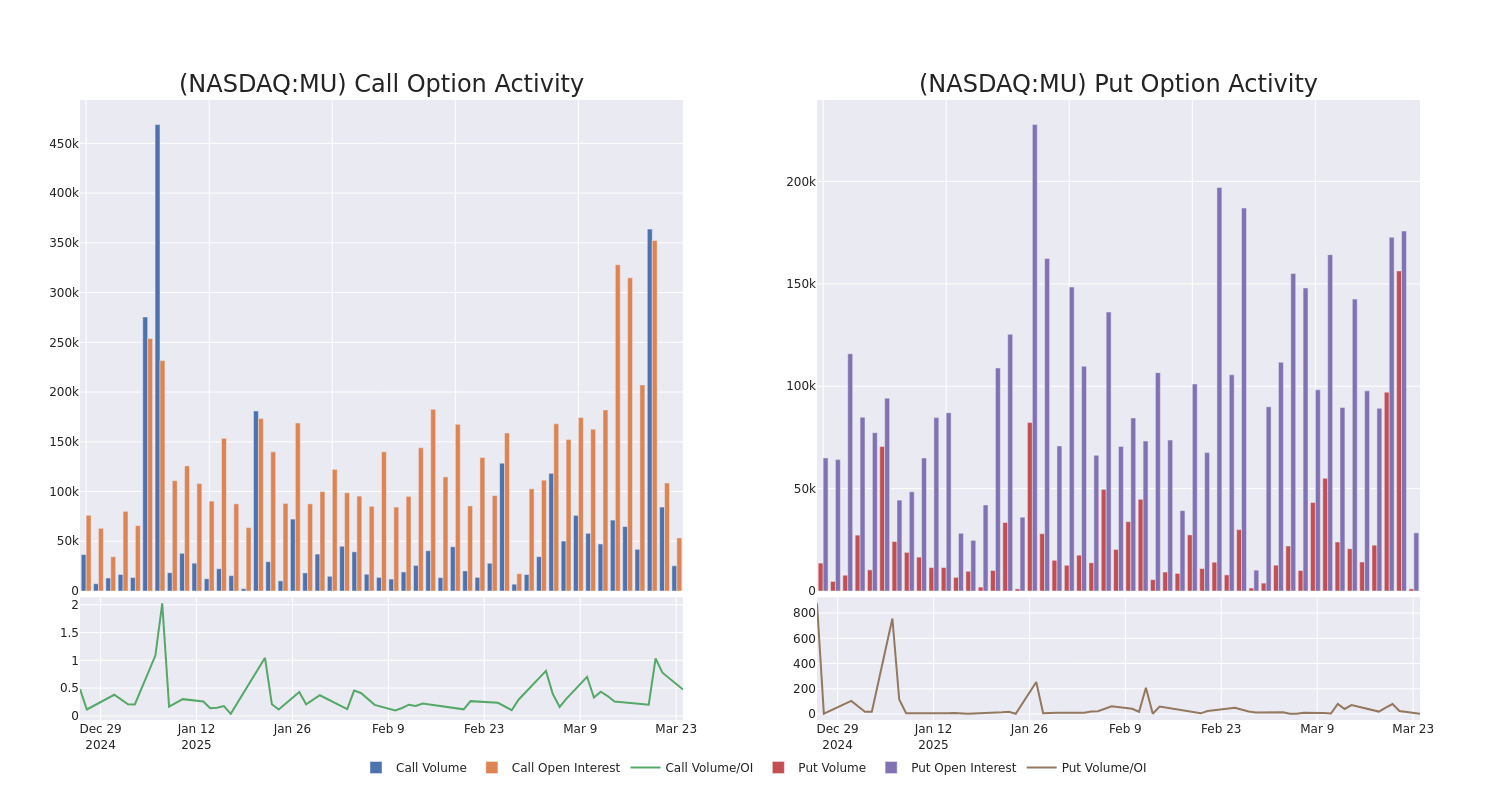

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Micron Technology’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Micron Technology’s substantial trades, within a strike price spectrum from $75.0 to $120.0 over the preceding 30 days.

Micron Technology 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BULLISH | 04/17/25 | $3.3 | $3.2 | $3.3 | $100.00 | $764.4K | 15.6K | 3.3K |

| MU | CALL | SWEEP | BULLISH | 05/16/25 | $11.7 | $11.65 | $11.7 | $90.00 | $585.0K | 2.0K | 1.0K |

| MU | CALL | SWEEP | BULLISH | 04/17/25 | $3.3 | $3.25 | $3.25 | $100.00 | $141.0K | 15.6K | 3.2K |

| MU | PUT | TRADE | BULLISH | 03/20/26 | $27.1 | $26.5 | $26.5 | $115.00 | $132.5K | 64 | 0 |

| MU | CALL | TRADE | BEARISH | 03/28/25 | $3.45 | $3.3 | $3.3 | $94.00 | $111.2K | 3.1K | 21 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Following our analysis of the options activities associated with Micron Technology, we pivot to a closer look at the company’s own performance.

Present Market Standing of Micron Technology

- Currently trading with a volume of 6,704,590, the MU’s price is up by 3.21%, now at $97.76.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 93 days.

Professional Analyst Ratings for Micron Technology

In the last month, 5 experts released ratings on this stock with an average target price of $134.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Wedbush downgraded its rating to Outperform, setting a price target of $125.

* Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on Micron Technology with a target price of $120.

* An analyst from Rosenblatt persists with their Buy rating on Micron Technology, maintaining a target price of $200.

* An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Micron Technology, which currently sits at a price target of $112.

* An analyst from Barclays has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $115.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.